5 min readNew DelhiFeb 16, 2026 05:13 AM IST

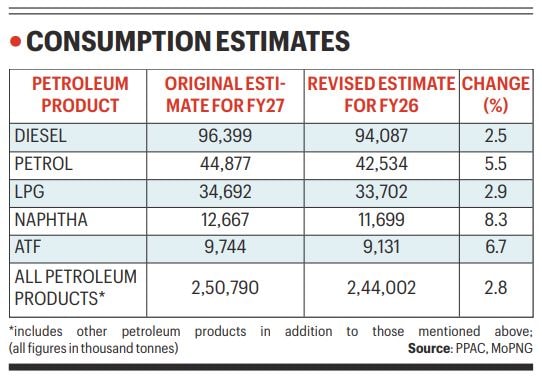

India’s consumption of refined petroleum fuels and products is expected to hit another fresh high in the upcoming financial year — 2026-27 (FY27) — on the back of steady growth in energy use across various sectors of the economy, as per latest government estimates. According to projections by the Petroleum Planning & Analysis Cell (PPAC) of the Ministry of Petroleum and Natural Gas (MoPNG), the country’s consumption of petroleum products — seen a proxy for crude oil demand — in FY27 is seen rising 2.8% over the revised estimate for FY26 to 250.8 million tonnes.

The consumption growth is expected to be led by fuels and products like petrol, aviation turbine fuel (ATF), liquefied petroleum gas (LPG), diesel, and naphtha. India’s petroleum consumption has been rising to reach a new high with each passing year, with the exception of two years when demand was hit because of the COVID pandemic. The revised estimate for the current fiscal — 244 million tonnes — is slated to be the highest-ever petroleum product consumption level so far, but will likely be topped in the next financial year. The current record consumption level — 239.2 million tonnes — was achieved in FY25.

An analysis of historical data shows that pre-pandemic record for consumption of petroleum products was 214.13 million tonnes (mt) in FY20. Demand took a hit in FY21 due to the pandemic, and posted a modest recovery in FY22. Consumption of most products breached pre-pandemic highs in FY23, and have been rising since.

India is seen as a major growth centre for oil demand given the future potential in energy-intensive industries, growing vehicle sales, a rapidly expanding aviation sector, expected growth in consumption of petrochemicals, and a still growing population with relatively low per-capita energy consumption. In fact, India is among the few markets where refinery capacity is expected to expand substantially over the coming years. India currently has a refining capacity of 258 million tonnes per annum, with average capacity utilisation levels of well over 100%.

But given its stagnant domestic oil production, rising demand for petroleum fuels and products is expected to lead to higher oil imports in the foreseeable future. India is the world’s third-largest consumer of crude oil with over 88% oil import dependency.

In November, International Energy Agency (IEA) said India will be the biggest driver of global oil demand over the next ten years, surpassing China, which accounted for over 75% of oil demand growth over the past 10 years. China is the world’s second-largest consumer of crude oil behind the US, but is the commodity’s biggest importer globally. However, oil demand growth in China has been subdued in the post-COVID era due to various factors, including growing adoption of vehicles powered by electricity and other alternative fuels, slump in sectors like real estate and construction, and investments shifting to sectors that are not oil intensive, among others.

“India leads global oil demand growth over the next ten years, with almost half of the additional barrels produced globally to 2035 heading in its direction. Its oil use increases from 5.5 mb/d (million barrels per day) in 2024 to 8 mb/d in 2035 as a result of rapid growth in car ownership, increasing demand for plastics, chemicals and aviation, and a rise in the use of LPG for cooking,” IEA said in its World Energy Outlook 2025.

Growth outlook for petroleum fuels

Story continues below this ad

Consumption of all major fuels — diesel, petrol, and LPG — is likely to touch an all-time high in the next financial year, as per PPAC’s projections. Consumption of diesel, the most used petroleum fuel in India, is seen rising 2.5% over the current fiscal’s revised estimate to 96.4 mt in FY27. Petrol consumption is likely to be higher by 5.5% at 44.9 mt. Higher demand for these fuels usually reflects robustness in the transportation and industrial segments.

LPG consumption is seen rising 2.9% y-o-y to 34.7 mt. Consumption of ATF is projected to register a growth of 6.7% to 9.7 mt in FY27, against the revised estimate of 9.1 mt for FY26. The demand for ATF represents the strong growth in India’s civil aviation market — now the third-largest domestic aviation market — that’s expanding rapidly.

The consumption of naphtha is also seen rising 8.3% y-o-y to 12.7 mt in FY27, as per PPAC’s projections. Naphtha is a major petrochemical feedstock, making it a vital input for manufacturing plastics and synthetic fibres. Some petroleum products, however, are estimated to see a slight decline in consumption in FY27 vis-à-vis FY26, such as petroleum coke, bitumen, fuel oil, lubricants, and light diesel oil. But their consumption volumes are significantly lower than demand drivers like diesel, petrol, and LPG.

© The Indian Express Pvt Ltd

.