4 min readNew DelhiUpdated: Feb 4, 2026 01:11 AM IST

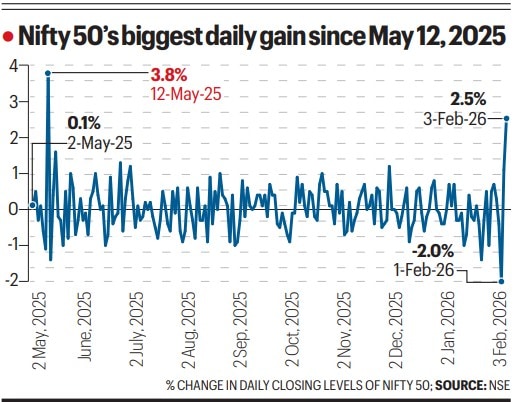

The Indian markets soared by 2.5% on Tuesday, buoyed by the conclusion of a trade deal between India and the US that saw tariffs on Indian exports to the US being slashed to 18% from 50%. The Sensex, which opened as much as 4.5% higher, ended 2.54% higher at 83,739.13 points, while the Nifty 50 closed at 25,727.55 points, 2.55% higher from Monday, more than erasing Sunday’s steep fall following the Budget announcement of a hike in the Securities Transaction Tax (STT) for futures and options on their way to posting the largest rise in almost nine months.

The rally was broad-based, with almost three-fourth of all stocks that trade on the BSE and all sectoral indices ending higher. Before Indian markets opened in the morning, American Depository Receipts (ADRs) of Indian companies listed on US exchanges had surged as investors cheered the late Monday announcement of a trade deal.

The delay in the trade deal has weighed heavily on Indian equity markets, which have also lagged others around the world due to India’s low exposure to the ongoing AI-led investment boom as well as weakening investor confidence amid the global geoeconomic and geopolitical uncertainty. Net outflows to the tune of nearly $12 billion from India’s equity markets during August 2025-January 2026 had compounded problems for the rupee, which has repeatedly tumbled to fresh all-time lows in recent months. On Tuesday, it staged a sharp recovery and gained more than 1% against the US dollar to end at 90.27 per dollar — its biggest rise in more than half a decade. Foreign investors returned to the market, snapping up Indian equities worth Rs 5,236.28 crore ($580 million), the highest in a little over 3 months, according to provisional data from the BSE.

“When countries are on good terms there is better flow of capital,” said Nilesh Shah, Managing Director, Kotak Mahindra Asset Management and a part-time member of the Economic Advisory Council to the Prime Minister. “The announcement of the deal will clear the imaginary constraints and it should lead to increased capital flow into the markets, which in turn will not only lift the markets but also strengthen the rupee.”

Shares of textile companies were among the biggest gainers on Tuesday, with Gokaldas Exports and Welspun Living hitting the 20% upper circuit. Many companies in the sector are major exporters and the US market accounts for a large portion of their revenues. Shrimp and aquaculture exporters such as Avanti Feeds and Apex Frozen Foods also hit the 20% upper band, with the sector depending on the US market for 50-70% of its revenues.

Other export-driven sectors such as chemicals, gems and jewelry, and some automobile and other equipment manufacturers (OEMs) also rallied sharply.

“With this deal announcement, we believe that the market will now begin to accord correct weightage to the improving trajectory of corporate earnings growth, which has shown successive improvement over the quarters with an improving earnings revision trend,” analysts at Motilal Oswal Financial Services said in a note on Tuesday. They added that valuations for Nifty “remain palatable” and could expand given the latest turn of events.

Story continues below this ad

However, experts also called for caution as the fine-print of the deal is awaited, especially with US President Donald Trump saying that India would halt its Russian oil purchases and buy $500 billion of US goods along with a move towards cutting down tariff and non-tariff barriers to zero.

India’s imports from the US in 2024-25 amounted to $46 billion. Its total global imports in the last fiscal year stood at $721 billion.

With an official press release still awaited, Radhika Rao, Senior Economist at DBS Bank, said that once the bilateral trade agreement is finally unveiled, it will provide more details on the beneficiary product lines and trade as well as investment commitments.

“While the US administration has called for a sharp cut in the tariff (nil on imports from the US) and non-tariff barriers from India, we expect the finer details to point towards a phased adjustment, evident in the other bilateral trade agreements that have been recently concluded. Selected sensitive and strategic sectors might be visited separately,” Rao added.

© The Indian Express Pvt Ltd

.