4 min readNew DelhiFeb 3, 2026 08:34 AM IST

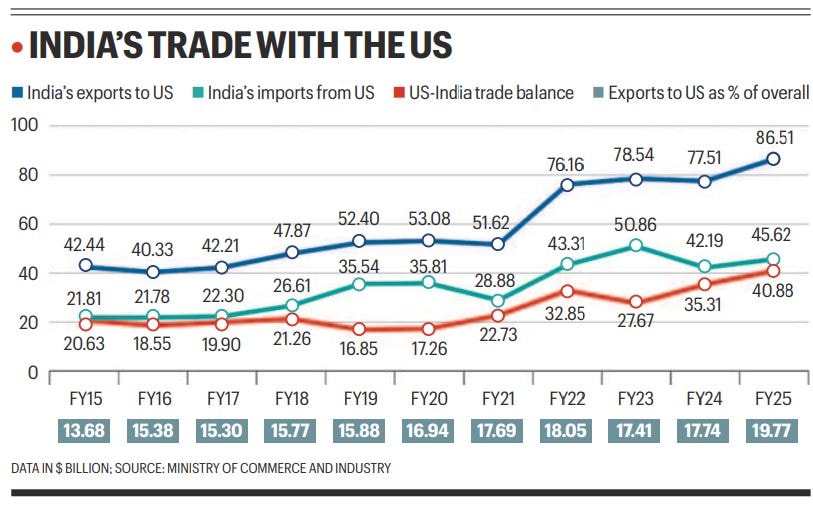

The India-US trade deal has finally fructified, with US tariffs coming down to 18% from 50% under the agreement reached on Monday. However, this came after significant challenges that pushed Indian exporters to diversify exports.

Indian exports suffered a decline in September and October due to the 50% tariffs that came into effect on August 27. However, overall exports in November jumped 19% as New Delhi’s exports to the US also jumped 22%, driven by products that are not part of the reciprocal tariffs.

Shipments in September — the first month to see the impact of 50% tariffs — showed that India goods managed to find markets elsewhere. Several trade deal negotiations which were stalled earlier also came back to prominence. New Delhi signed a trade deal with the EU, UK, Oman and also concluded the New Zealand deal while facing steep tariffs.

The Commerce and Industry Ministry has also resumed trade talks with Canada and Israel, which were canned earlier. While the political relationship with Canada led to the rupture of a trade deal with Canada, talks with Israel stopped in 2022 as Indian negotiators were not convinced about the gains from the trade deal. However, India is now exploring a preferential trade agreement with Israel.

Analysis of data released by the Commerce and Industry ministry showed that while gems and jewellery exports to the US plummeted 76% in September compared with last year, total gems and jewellery exports registered only a marginal 1.5% dip. Shipments to the UAE jumped 79%, to Hong Kong 11%, and Belgium 8%, the data showed.

A similar pattern was visible in auto components, whose exports to the US dropped 12% in September, but shipments to Germany, the UAE, and Thailand helped total auto component exports grow 8%. Marine products grew 23% in September and 11% in October, largely due to higher exports to China (up almost 60%), Japan (37%), Thailand (about 70%) and the European Union.

However, low-margin, labour-intensive product segments such as cotton garments, sports goods, carpets, and leather footwear, which face stiff competition from China and the Association of Southeast Asian Nations (ASEAN) countries, are struggling to diversify their shipments, indicating that the long-term impact of US tariffs could be uneven, hitting small units operating across the country more. The low-margin products are typically more susceptible to trade-related shocks due to working capital stress and are unable to set up units abroad.

Story continues below this ad

Sports goods, with 40% exports going to the US, have not yet found alternate markets, and hence, higher tariffs have dragged down overall exports by 6% in October.

The cotton garment sector, where Indian products have large competitors such as Vietnam and Bangladesh, too, struggled in its diversification efforts. After a 25% decline in exports to the US, shipments to the UAE, Spain, Italy and Saudi Arabia went up, but the category exports slipped 6% in September. Similarly, leather footwear exports also registered a 10% overall decline after a sharp dip in exports to the US.

According to an SBI’s Ecowrap report released in November, India’s exports managed to find alternate markets and that diversification could help India withstand the US tariff hit over a period of time.

The report said India’s total merchandise exports between April and September this year inched up by 2.9%, and cumulative exports to the USA also registered a growth of 13% during the same period, though there could be some front-loading effects, with September figures for the US registering negative year-on-year growth of 12%.

© The Indian Express Pvt Ltd

.