The third quarter (Q3) financial results have not started off on an exciting note. What has clearly stood out is the hit taken by information technology (IT) companies from the Labour Codes. Between the six of them — Tata Consultancy Services, Infosys, HCL Technologies, Wipro, Tech Mahindra, and LTIMindtree — India’s leading IT firms set aside over Rs 5,500 crore in the October-December quarter for the implementation of these codes and the higher employee benefits entailed.

Index bellwethers, Reliance Industries and ICICI Bank have also posted lower-than-expected earnings numbers. The IT sector notwithstanding, there are some worrying signs from other sectors. Take the oil-to-data conglomerate Reliance Industries (RIL), whose earnings before interest, tax, depreciation, and amortisation (EBITDA) missed forecasts, primarily because of weak results for consumer-focused Reliance Retail, whose Q3 EBITDA was up just 1.3% year-on-year (y-o-y) — hardly a ringing endorsement for consumption growth.

In the financial sector, heavyweights ICICI Bank and HDFC Bank reported a 6-8% rise in Q3 net interest income, lower than the 8-9% growth reported in the year-ago period. This is interesting because in the interim, the Reserve Bank of India (RBI) has sharply lowered the policy repo rate to 5.25% and growth in non-food bank credit rose to 11.4% as at the end of November.

The unimpressive Q3 earnings are noteworthy since they follow the Goods and Services Tax (GST) rate cuts of September 22. The indirect tax cuts — in conjunction with low inflation — were instrumental to analysts projecting an upbeat 2026. In late September, HSBC even upgraded its view on the Indian stock market to ‘overweight’ from ‘neutral’.

Demand troubles in corporate results

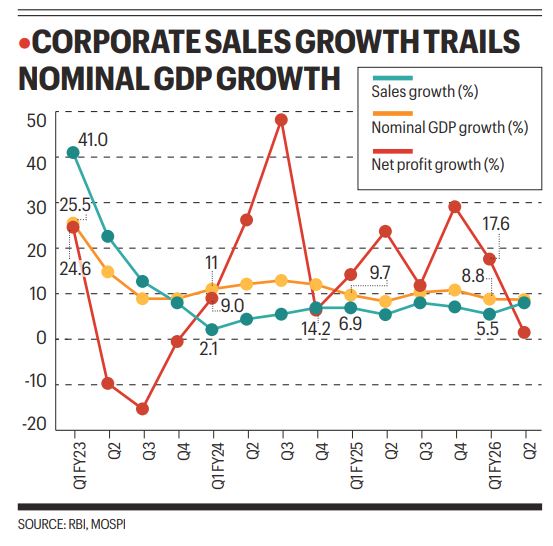

Revenue growth for Indian companies has been a problem for some time, even though profits have surged — although these trends have been reversing. According to an RBI analysis of over 3,000 listed private, non-financial firms, July-September 2025 saw sales rise 8% y-o-y, the joint-most since a 12.7% rise seen in October-December 2022. At the same time, net profit growth of these companies fell to 1.5% in Q2 — the lowest since the last quarter of FY23. Perhaps it’s too early to form a view on Indian companies and 2026 might indeed be better. The foundations seem fairly firm, the US tariff situation notwithstanding. For instance, there is no doubt that India Inc. is in a healthy position, with their ability to service debt rather comfortable. Meanwhile, Fitch Ratings’ analysts said Tuesday that they expect the Indian companies they rate to post an EBITDA margin of around 16% in FY27, up from an estimated 15.3% this year, with the wider margin seen helping offset high capex intensity. Any sign of increased investments should be good news for the economy.

The incoming quarterly results also have something to say about the K-shaped economic recovery India has seen after the COVID-19 pandemic. Take luxury hotel company Leela Hotels, for instance, which last week reported a 21% increase in operating revenue, 23% rise in operating EBITDA, and 20% growth in RevPAR in Q3, with the occupancy rate rising to 71%. It reported double-digit growth in RevPAR and EBITDA for the fifth consecutive quarter.

On Tuesday, ITC Hotels reported a 13% rise in RevPAR on its way to posting a 21% rise in revenue from operations. And even after taking a Rs 55 crore hit due to the Labour Codes, profit after tax for the reporting quarter was up 10%. According to ITC Hotels, demand particularly in premium and leisure segments is likely to “outpace available inventory” in the medium to long term.

Story continues below this ad

In another sign of the premium shift of Indian consumers, Japanese brokerage firm Nomura last week began coverage of United Spirits. “Consumers are evolving towards premium experiences and are shifting from ‘drinking more’ to ‘drinking better,’ as prestige & above brands are growing faster than popular ones,” Nomura analysts said on January 14. “This indicates that the industry is at an inflection point of a premiumisation upcycle.”

Undoubtedly, more information will be available once fast moving consumer goods companies announce their financial results, although one will have to take the post-GST cut numbers with a pinch of salt and not necessarily as the new normal.

© The Indian Express Pvt Ltd

.